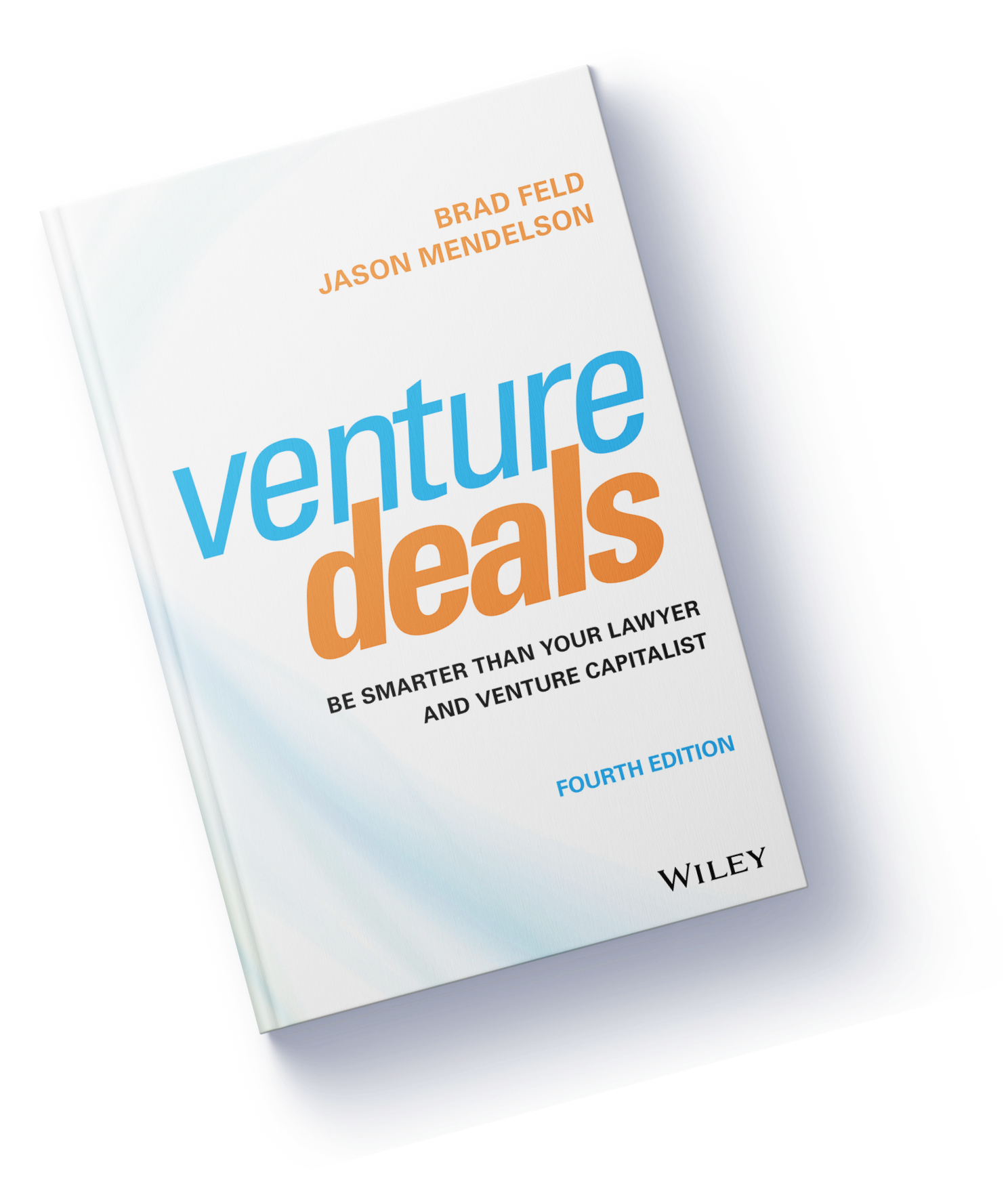

The book

How do venture capital deals come together? This is one of the most frequent questions asked by each generation of new entrepreneurs. Surprisingly, there is little reliable information on the subject.

Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist is a must-have resource for any entrepreneur, venture capitalist, or lawyer involved in VC deals as well as students and instructors in related areas of study.

“It’s a textbook on venture capital deals. If you plan to do one of them, as an investor, advisor, or most importantly, as an entrepreneur, you should get this book and read it.”

“After reading it, I’ve concluded that it’s like having a super-mentor on your shelf”

“If you’re an entrepreneur or VC or will be working in this industry – buy this. read it. live it”

Blog

Embroker’s 21 Best Startup Books to Help You Scale

It’s always fun to make a top 21 book list, even if the list names the first edition of Venture Deals (now in it’s fourth edition). Embroker has a list of 21 Best Startup Books to Help You Scale. In addition to Venture Deals, there are a bunch of great books on the list if […]

Read more

Venture Deals Online Course – Summer 2020 Edition

We are running the Venture Deals Online Course from June 28, 2020 – August 21, 2020. We usually only run it twice a year (Spring and Fall), but given the Covid crisis, we’ve had many requests to run it this summer. We’ve now had over 20,000 people take it. The last cycle was particularly fun as several […]

Read more

Jason Mendelson Demystifying Venture Deals on the Give First Podcast

Jason Mendelson, co-founder of Foundry Group, can explain what matters in negotiations between entrepreneurs and VCs in just two words: Control and Economics. It takes enormous expertise to make something complicated really simple, and these bare two words speak to Jason’s profound understanding of venture deals and how they work, for the entrepreneur, the investor, […]

Read more

Venture Deals Review Podcast by Vela | Wood

When I was in Dallas recently, I met Kevin Vela, one of the founders of the Vela | Wood law firm. He told me about the Venture Deals Review podcast that he had done with his associate Aaron Terwey. The podcast is 19 episodes, each about a half hour, going through the chapters of Venture […]

Read more

Embroker’s 21 Best Startup Books to Help You Scale

It’s always fun to make a top 21 book list, even if the list names the first edition of Venture Deals (now in it’s fourth edition). Embroker has a list of 21 Best Startup Books to Help You Scale. In addition to Venture Deals, there are a bunch of great books on the list if […]

Venture Deals Online Course – Summer 2020 Edition

We are running the Venture Deals Online Course from June 28, 2020 – August 21, 2020. We usually only run it twice a year (Spring and Fall), but given the Covid crisis, we’ve had many requests to run it this summer. We’ve now had over 20,000 people take it. The last cycle was particularly fun as several […]

Jason Mendelson Demystifying Venture Deals on the Give First Podcast

Jason Mendelson, co-founder of Foundry Group, can explain what matters in negotiations between entrepreneurs and VCs in just two words: Control and Economics. It takes enormous expertise to make something complicated really simple, and these bare two words speak to Jason’s profound understanding of venture deals and how they work, for the entrepreneur, the investor, […]

Venture Deals Review Podcast by Vela | Wood

When I was in Dallas recently, I met Kevin Vela, one of the founders of the Vela | Wood law firm. He told me about the Venture Deals Review podcast that he had done with his associate Aaron Terwey. The podcast is 19 episodes, each about a half hour, going through the chapters of Venture […]

Resources

Here you will find some standard forms of documents used for early stage financings. These documents were developed at Cooley and were originally based on the National Venture Capital Association (NVCA) model documents.

GET RESOURCES